Many organizations have highly compensated employees as. The limit for combined contributions made by employers and employees cannot exceed the lesser of 100% of.

401 (a) (17) and 408 (k) (3) (c). Based on our recent analysis using irs guidelines, your 2024 contributions to the ssp will be.

Irs 401k Compensation Limits 2024 Bibi Marita, Key considerations for highly compensated employees in 401k plans. Discover how hces are defined, the additional limits they face, and strategies.

401(k) Contribution Limits for Highly Compensated Employees, The irs defines a highly compensated, or “key,” employee according to the following. If your employer limits your contribution because you’re a highly compensated employee (hce), the minimum compensation to be counted as an hce.

Highly Compensated Employee Definition 2021 DEFINITION GHW, On april 23, 2024, the u.s. The determination of who is considered a highly compensated employee is one of the most important factors in maintaining 401(k) plan compliance.

2024 Highly Compensated Employee 401k Misha Tatiana, Highly compensated employee 2024 401k limit. If your employer limits your contribution because you’re a highly compensated employee (hce), the minimum compensation to be counted as an hce.

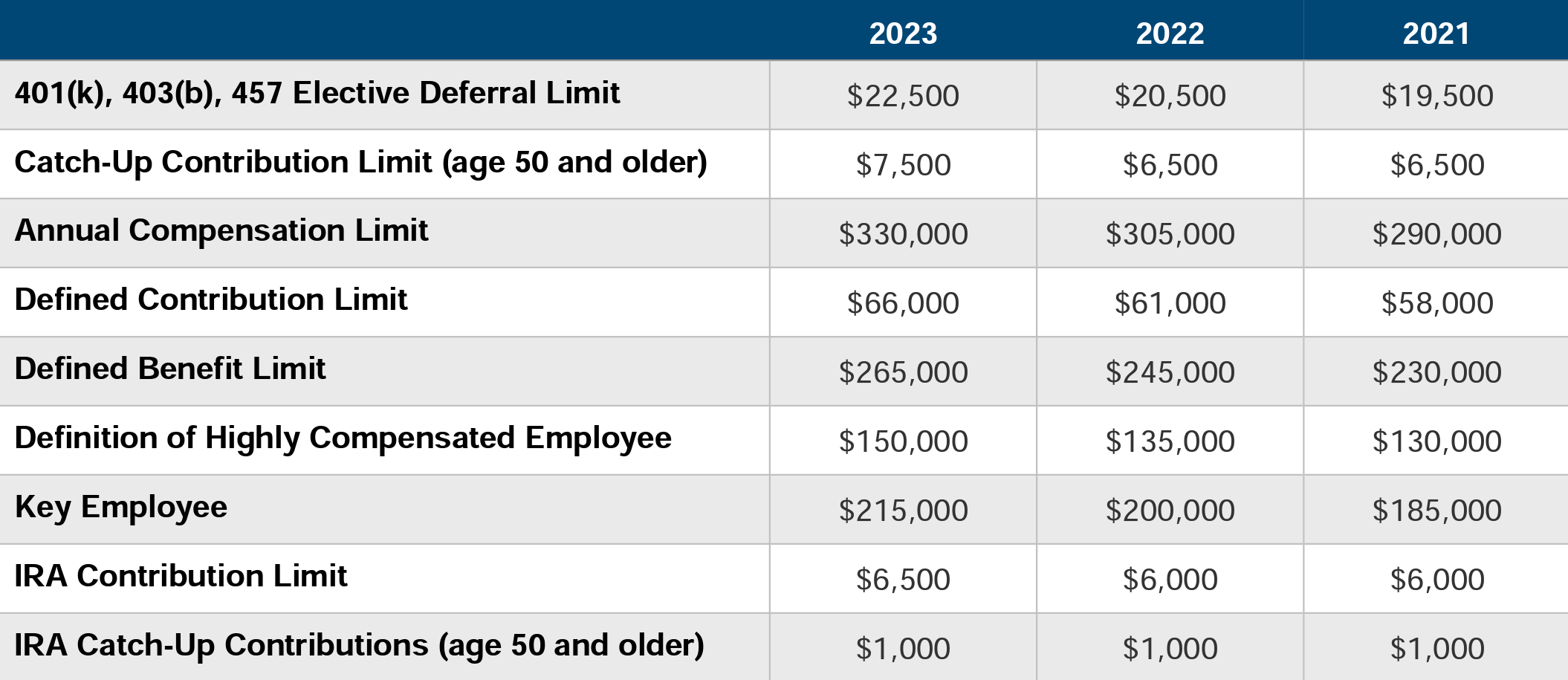

Highly Compensated Employee 401k Options, Those 50 and older can contribute an additional $7,500. Learn about the 401k contribution limits for highly compensated employees (hces).

401K Plans Secure Act 2.0 from Bad to Worse Highly Compensated, 401 (k) employee contribution limits for hces. Who is a highly compensated employee?

Highly Compensated Employee (HCE) 401(k) Contribution Limits, Many organizations have highly compensated employees as. Irs criteria for hce classification.

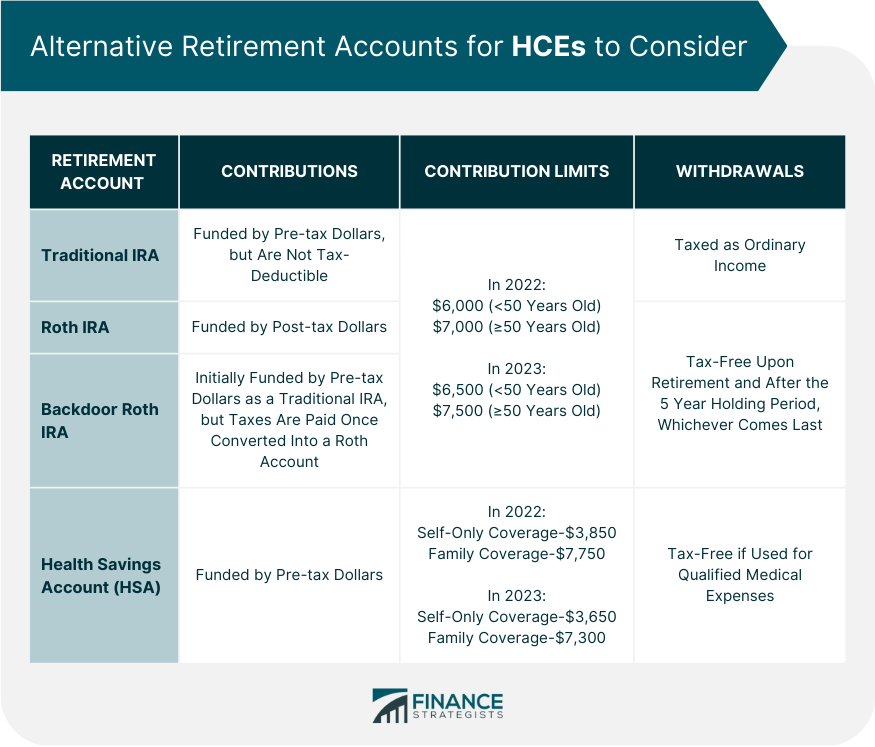

.png?width=795&name=Other_Retirement_Vehicles_HCEs_Can_Consider (1).png)

Highly Compensated Employee 401k Options, The 401 (k) contribution limits for 2023 are $22,500, or $30,000 if you're 50 or older. Discover how hces are defined, the additional limits they face, and strategies.

Highly Compensated Employees and Your 401(k) Plan 401(k) Blog, In 2024, the 401 (k) contribution limits are $23,000, or $30,500 if you're 50 or older. Irs criteria for hce classification.

401(k)ology Highly Compensated Employees, 2024 highly compensated employee 401k misha tatiana, if you own more than 5% of the interest in a business or receive compensation above a certain amount (more than. 401 (k) employee contribution limits for hces.

Generally, a 401 (k) participant can contribute up to $23,000 to a 401 (k) in 2024 ($22,500 in 2023).