2025 Gift Tax Annual Exclusion. If one makes gifts in excess of the annual gift tax exclusion, one must file a gift tax return, due april 15 in the following year, to report the gift and track the amount of the lifetime. Watch this video for a breakdown of the irs gift tax rules & regulations for 2025 and 2025.

The first thing to understand is the annual gift tax. The exclusion will be $19,000 per recipient for.

Lifetime Gift Tax Exclusion 2025 Irs Harry Hill, The 2025 annual exclusion for gifts will be $19,000, up from $18,000 in 2025.

2025 Gift Tax Annual Exclusion Anthia Brigitte, The gift tax annual exclusion amount is set to increase from $18,000 per person in 2025 to $19,000 per person in 2025.

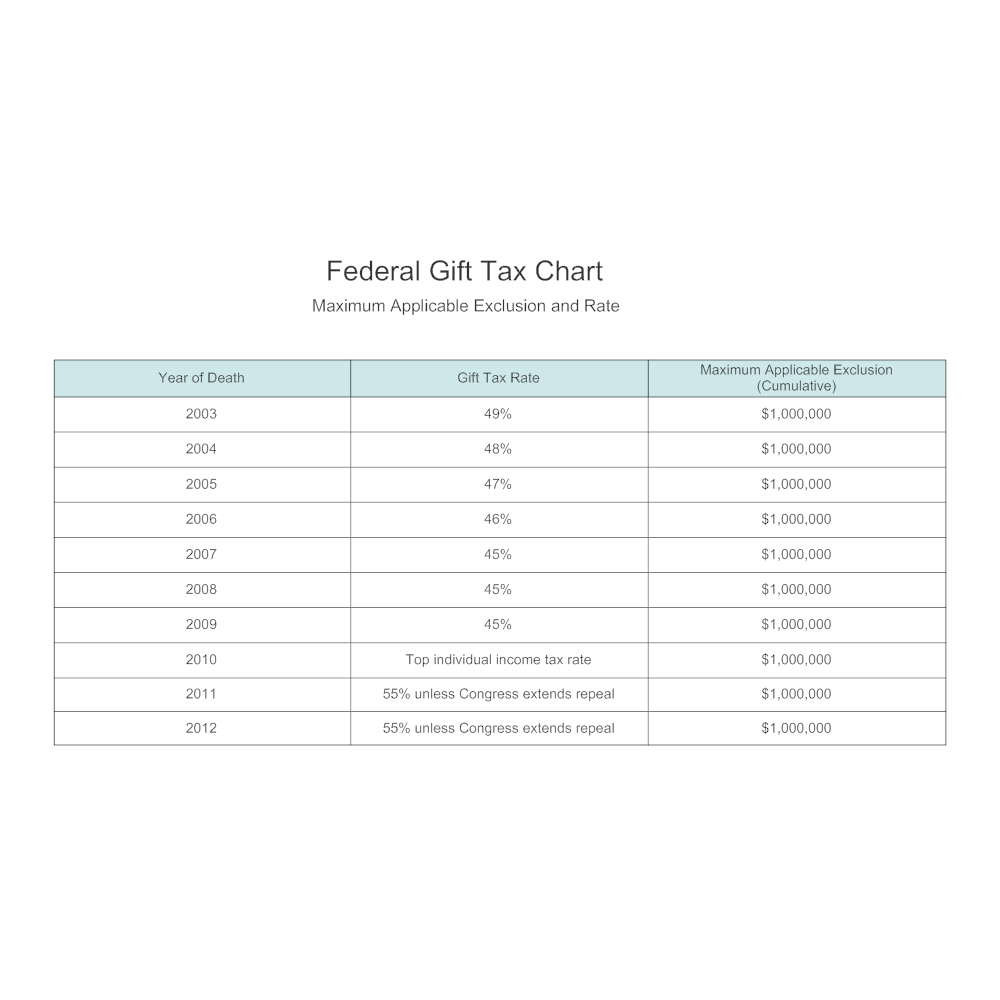

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, If one makes gifts in excess of the annual gift tax exclusion, one must file a gift tax return, due april 15 in the following year, to report the gift and track the amount of the lifetime.

Annual Gift Tax Exclusion Amount Increases for 2023 News Post, This could help the middle class and boost consumption in the.

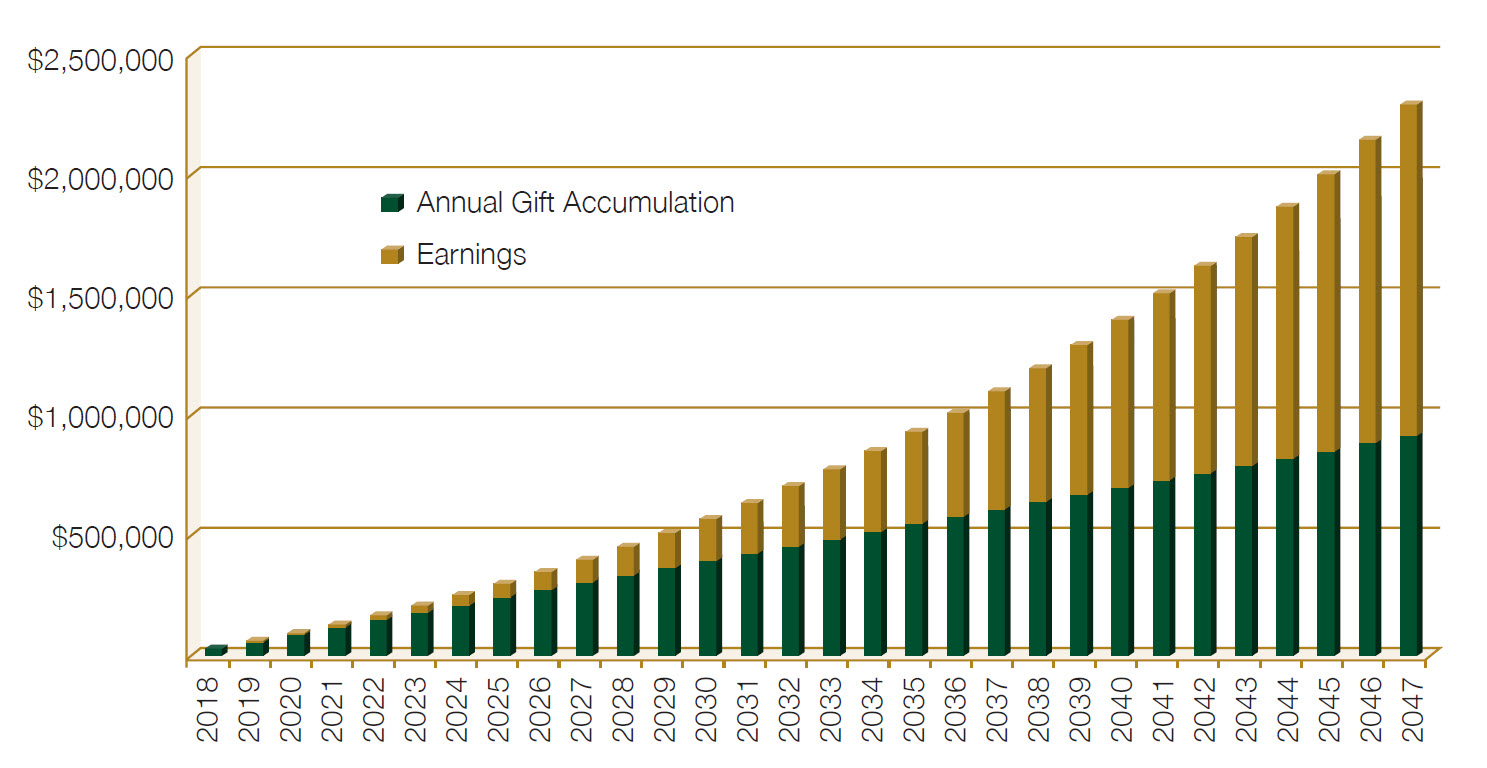

Annual Federal Gift Tax Exclusion 2025 Niki Teddie, Any gifts that exceed the annual exclusion amount count toward the lifetime exemption.

Annual Gift Tax Exclusion A Complete Guide To Gifting, The gift tax annual exclusion amount is set to increase from $18,000 per person in 2025 to $19,000 per person in 2025.